Why is Slovenia your perfect destination for studying abroad?

Slovenia is an excellent destination for international students looking to grow academically and professionally. With a wide range of study programs at higher education institutions such as universities, professional colleges, and art academies, listed among the top best universities in the world, and affordable living costs, it’s no wonder that more and more students are choosing Slovenia as their prime study destination.

In addition to these practical considerations, Slovenia is also a beautiful country with a rich history and culture, welcoming people, and numerous natural wonders. Plus, there are many scholarship schemes available for international students, and many courses are taught in English, making it easier for students to adjust to life in Slovenia.

So, how can you study in Slovenia?

The process is relatively straightforward: first, explore your options and choose a university and course that meet your needs and interests. Next, check the eligibility criteria and required documents for your chosen course, and gather all necessary paperwork. Then, fill out the application form correctly and submit it along with the required documents. If you are accepted, the university will issue an offer letter, which you will use to apply for a study visa. Once you have your visa, you can fly to Slovenia and begin your studies.

There are many great courses to choose from in Slovenia, including computer and information science, medicine, management and administration, economics, engineering, architecture, marketing, and tourism. No matter what your background or interests, you’re sure to find a course that fits your needs.

Universities in Slovenia

Despite being a small country in Europe, Slovenia has some of the best universities and is ranked among the top best universities of the world. foreign students can easily secure their seats in these universities. Some of the best universities in Slovenia are:

- University of Ljubljana, Ljubljana

- University of Maribor, Maribor

- University of Nova Gorica, Nova Gorica

- University of Novo Mesto, Novo Mesto

- University of Primorska, Koper

- EMUNI University

- Alma Mater Europaea – Institutum Studiorum Humanitatis (AME ISH)

- International School for Social and Business Studies

- Jošef Stefan International Postgraduate School

- Academy of Visual Arts, Ljubljana

To apply to a university in Slovenia, you’ll need to provide some important documents, such as a filled-out application form, educational certificates, a language proficiency certificate, a copy of your passport, a motivation letter, letters of recommendation, and potentially other documents depending on your course of study.

Tuition fees Slovenia

At public universities in Slovenia, students from the EU (European Union ) countries and from the former yugoslavia( Montenegro Bosnia and Herzegovina Serbia Kosovo North Macedonia) don’t have to pay tuition fees for Bachelors or Masters. For non-EU students and third country nationals, tuition fees differ with the institution and course chosen. On average:

- A Bachelor’s degree ranges from 2,000 EUR to 5,000 EUR.

- Master’s degree from 2,500 EUR to 7,500 EUR ,

- 3,000 EUR to 12,000 EUR for Doctorate(PHD).

Cost of living in slovenia.

Slovenia is one of the best destinations that offers relatively low cost of living for international students., Student meals are subsidised by the government, almost 80% of restaurants adhere to it, making the overall cost of living for students comparatively low.

In Slovenia, you can opt for living in student dormitories, where monthly rent is about 120-250 EUR, all inclusive. You can also live in private flats where rent is a bit higher, but still not so bad.

Applying for a Student Visa to Study in Slovenia.

- Application fee.

- Two passport size photos

- Your fingerprints will be taken

- A passport, valid for at least 3 more months after the completion of the course in Slovenia.

- A certificate or letter proving your admission at a Slovenian university.

- Health insurance

- Certificate of non-conviction from your home country(criminal record).

- Proof that you can cover all your expenses while studying in Slovenia.

Overall, Slovenia is a great choice for international students looking for high-quality education at an affordable price in a beautiful and welcoming country. With its wide range of study options, scholarship opportunities, and affordable living costs, it’s no wonder that more and more students are choosing to study in Slovenia.

Why is Slovenia your perfect destination for studying abroad? Read More »

Merry Christmas.

Life will be worth living, dreams will come true, opportunities will come if we keep the Christmas spirit the whole year through.

Our Christmas wishes to you all.

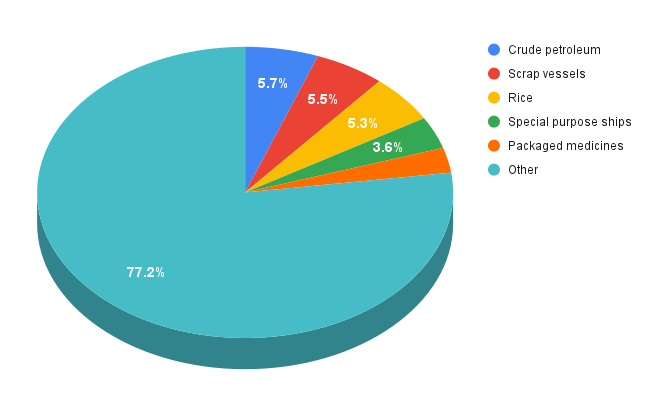

Cameroon Import and Export statistics

Cameroon is, going by the latest estimates, home to over 29 million people. A large and fast-growing economy. It is rapidly changing its economy from mostly based on small farming to an advanced economy.

As such, it is expected that there is a great demand for different types of imports. Looking at the general imports is not as useful, as a lot of the sectors for imports are just too diverse. Zooming in into the details, we can see that a large part of the imports are Scrap Vessels, Rice, and Medicine.

Cameroon is one of the largest importers of scrap vessels – presumably for dismantling or repair, and the largest importer is their neighbour Nigeria.

The major import of Rice – a staple food in the region – is mostly supplied by Thailand.

The medicine imports mostly come from France – a long-standing trade partner, China and India.

From the smaller but important imports, we have cars that are mostly imported from Europe and the US. While tractors and motorcycles arrive from China.

The imports arrive from different countries. China is the largest importer of mixed goods.

Most of the trade with Nigeria is in the Scrap vessels market.

France and Belgium import diverse products, mostly due to their language.

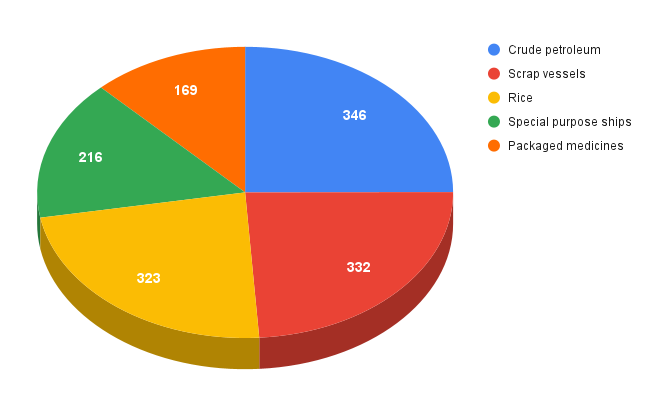

Exports are essential to offset the large demand for imports. Cameroon has a large imbalance. In 2019, Cameroon exported $5.21 billion of goods and services and imported $6.07 billion, resulting in a negative trade balance of $86 million, according to Massachusetts Institute of Technology statistics. According to OEC, Cameroon Exported $3.69 billion in 2020 and imported $6.73 billion.

By far the largest Export is Crude Petroleum and Petroleum gas, followed by Cocoa in the form of beans, butter and paste. When it comes to materials, Wood, gold and Aluminium are important. And Bananas take a large chunk of exported foodstuff.

Looking at the counties Cameroon is trading with, Cameroon has a strong trading partner for gold in the UAE. A monopoly that should perhaps be taken on. Wood is mostly exported to China, with processed wood – that should reach greater added value – finding their market in Europe. That is also the main market for Bananas, Cocoa. The last important export is Aluminium, exported mostly to Europe.

Cameroon Import and Export statistics Read More »

Des sociétés d’État Camerounaise prête à être introduire en bourse.

Dans le cadre de la dynamisation de la Bourse des valeurs mobilières de l’Afrique centrale (Bvmac), basée à Douala, l’État du Cameroun a communiqué le 8 septembre dernier la liste de quatre entreprises devant être introduites en bourse. « Monsieur le directeur général, j’ai l’honneur de vous faire savoir que par lettre (…) datée du 29 août 2022, le ministre d’État, secrétaire général de la présidence de la République, me notifie le très haut accord du président de la République du Cameroun, pour la cotation des entreprises Aéroports du Cameroun (ADC), Cameroon Hotels Corporation (CHC), Port autonome de Douala (PAD), et Société de développement du coton (Sodecoton) à la Bourse des valeurs mobilières de l’Afrique centrale (Bvmac) », peut-on lire dans la lettre adressée au directeur général de la Bvmac, Louis Banga Ntolo, par le ministre camerounais des Finances, Louis Paul Motazé.

Après plus de 2 ans de retard, le Cameroun est donc en passe de respecter l’engagement pris par les six États de la Cemac (Cameroun, Congo, Gabon, Tchad, RCA et Guinée équatoriale) de contribuer à dynamiser le marché financier sous-régional unifié, en y introduisant des entreprises publiques ou à capitaux mixtes. Le Cameroun a été devancé par le Gabon, le Congo et la Guinée équatoriale qui ont, depuis plusieurs mois, fait tenir à la Bvmac une liste de 10 entreprises au total, pour leur introduction en bourse.

L’une de ces entreprises, Banco nacional de Guinea ecuatorial (Bange Bank) en l’occurrence, est même déjà listée à la Bvmac depuis le 28 septembre 2022, avec une action à 206 220 FCFA dès son arrivée sur le marché. Le réassureur gabonais SCG Ré a, quant à lui, entamé le processus d’entrée en bourse. SCG Ré pourrait très bientôt être suivi par l’une des quatre entreprises proposées par le Cameroun et dont les profils apparaissent plutôt intéressants pour les potentiels investisseurs.

Une aubaine pour Geocoton à la Sodecoton

Il s’agit d’abord de la Sodecoton, un mastodonte agro-industriel qui encadre environ 200 000 producteurs de coton dans les trois régions septentrionales du Cameroun. Cette entreprise, dont l’État détient 59% du capital a réalisé un bénéfice de 8,4 milliards FCFA au cours de la campagne cotonnière 2021-2022, après une perte de 4,7 milliards FCFA la campagne précédente, en raison des ravages du Covid-19. Cette unité agro-industrielle est engagée dans un plan de développement de son outil de production, avec notamment la construction annoncée de nouveaux magasins de stockage, la 11e usine d’égrenage du coton et une nouvelle huilerie. Tous ces investissements sont réalisés dans la perspective d’une production attendue à 400 000 tonnes en 2025 (contre 309 021 tonnes en 2021-2022).

L’introduction en bourse de la Sodecoton pourrait surtout être une opportunité pour le Français Geocoton, son 2e actionnaire avec 30% du capital, de se repositionner plus solidement dans le tour de table de cette entreprise dans laquelle la SMIC du milliardaire Baba Danpoulo détient également 11% des parts. En effet, en 2020, apprend-on de sources autorisées, Geocoton a discrètement fait à l’État du Cameroun une offre de prise de participations majoritaires dans le capital de la Sodecoton, en échange d’une enveloppe d’investissements de 60 milliards de FCFA sur 7 ans. Une offre déclinée à l’époque par l’État.

Ensuite, l’État du Cameroun se propose de céder sur le marché financier unifié de l’Afrique centrale, une part de ses actifs dans le Port autonome de Douala (PAD), l’entreprise publique qui gère le port de Douala. Avec plus de 80% du trafic import-export, cette plateforme demeure la principale porte d’entrée du Cameroun, malgré la construction récente du port en eau profonde de Kribi. Grâce à un bénéfice de 6,4 milliards de FCFA en 2021, après 6,3 milliards en 2020 (en hausse d’un milliard de FCFA en glissement annuel, NDLR), dans un contexte de crise sanitaire, le PAD est parmi les rares sociétés d’État du Cameroun qui affichent une santé financière enviable. Doté d’un ambitieux plan d’extension vers la zone de Manoka, le PAD, qui déroule un programme de modernisation de ses infrastructures et équipements depuis quelques années, a depuis 2020 repris à son propre compte la gestion du terminal à conteneurs, ainsi que les opérations de dragage du chenal, de lamanage et de remorquage ; jadis concédées aux entreprises étrangères.

ADC et CHC impactés par le Covid-19

Enfin, parmi les candidats à l’introduction à la bourse présentés par le Cameroun, l’on retrouve les ADC et CHC. Société d’État chargée de la gestion de toutes les plateformes aéroportuaires du pays, les ADC, détenus à 71% par l’État, ont réalisé un résultat net de 6,7 milliards de FCFA en 2019, secondant ainsi la CNPS, le fonds public de pension, dans le top 5 des entreprises publiques ayant réalisé les bénéfices les plus importants cette année-là. Mais, ce résultat bénéficiaire s’est mué en une perte sèche de 7 milliards de FCFA en 2020, en raison de la baisse de 62% du trafic international dans les aéroports du Cameroun, du fait de la pandémie du Covid-19.

La société Cameroon Hotels Corporation (CHC) est certainement la moins connue de toutes les quatre proposées par le gouvernement pour leur introduction en bourse. Cette entreprise publique (95,6% du capital appartient à l’État) n’est rien d’autre que le propriétaire du Hilton Hôtel de Yaoundé, seule enseigne cinq étoiles du Cameroun avant l’arrivée fin 2021du Chrystal Palace de Douala. CHC a vu son résultat net baisser de 677,59% pour se situer à -1,75 milliard en 2020 du fait de la pandémie du Covid-19. Mais, selon des données de la direction générale des impôts, l’activité hôtelière est en pleine reprise. Dans son plan d’expansion, CHC ambitionne de s’étendre à la ville de Kribi, la cité balnéaire du Sud du pays, au moyen de la construction d’un hôtel haut standing.

La Commercial Bank Cameroon aussi…

La grande absente de cette liste est la Commercial Bank Cameroon (CBC), banque detenue par le milliardaire Victor Fotso de regrettée mémoire, mais passée sous le contrôle de l’État (98% du capital) depuis quelques années après une longue période de restructuration (7 ans) et une recapitalisation. « L’introduction en bourse de la CBC est déjà actée. Je pense que l’État n’a simplement pas jugé nécessaire de le rappeler en l’ajoutant à cette liste », analyse un habitué du marché financier sous-régional.

En effet, apprend-on de sources proches du dossier, le plan de désengagement de l’État de la CBC prévoit la cession de 51% des actifs à un partenaire stratégique et l’ouverture de 30% du capital aux investisseurs de la Bvmac. Au terme du processus pour lequel le ministère des Finances a lancé un appel à manifestation d’intérêt en début d’année 2022, en vue du recrutement d’un conseil devant accompagner l’État, le Cameroun ne conservera que 17% du tour de table de cette banque qui affiche plutôt fière allure depuis la reprise de ses actifs par l’État (résultats nets respectifs de 1,5 et 2,5 milliards de FCFA en 2017 et 2019, puis augmentation des fonds propres de 11 milliards de FCFA à fin 2020).

Data sources: https://www.investiraucameroun.com/

Des sociétés d’État Camerounaise prête à être introduire en bourse. Read More »

Slovenian Agriculture

After the second world war the slovenian agriculture is taking a gradual but constant shift. In the beginning of the second half of the 20th century most of the population was relying on farming as their main source of income supplemented by tradesmen activities during the down period.

This gradually changed as the push for industrialization drove people from the farms into cities that offered better living. The government encouraged farming innovation by establishing cooperatives (Zadruge) where traditionally small farmers could borrow machinery in order to increase their productivity. The general layout of Slovenia does not promote large scale food production that is prevalent in most of the modern world. Even with merging of farms, increase in mechanisation and advances in other fields the farming is not a profitable business and a large portion of the population maintains farms as a secondary activity subsidising their income from the regular job. At present only about 5% of the population is reliant on farming for their income. And this is with subsidies offered by the EU for their work – these provide a major incentive for continuing in the field that would otherwise be too expensive to work with.

There is however an interesting and relatively large class of people who work a full time job but maintain a small farm in order to reduce their daily expenses. These are usually children of farmers, who inherited the land from their parents who also invested in the equipment.

The hallmark and the simbol of these farmers is perhaps the tractor. (Tomo Vinkovič)

These humble looking tractors, first produced in 1976 are incredibly robust and versatile. The production of these tractors stopped in 1989. But even more than 30 years later they are still the most common tractor in slovenia. They offer a lot of versatility due to the modifications done by the farmers who in order to reduce costs modified their horse and oxen driven implements to attach to these “beasts of burden”.

Due to specificity of the land the government put a lot of emphasis on the education of their farmers establishing a specialised Faculty in 1947 (Directly after the end of WW2). The Faculty has been focused on innovation, establishing several new cultivars that suit the Slovenian climate. Due to the changes in the environment – dryer summers – they are trying to develop specific drought resistant crops.

Prognosis:

Slovenian agriculture is on one hand behind in development due to fractalization – a lot of small farms that are not sustainable on their own. Because of this it is – on average – a few decades behind the neighbouring countries. But this is not necessarily a bad thing. Newer technologies that are gaining traction in the opposite side of the spectrum could be implemented extremely efficiently on these smaller plots of land that emphasise automation on a smaller scale. It is expected that a large sector of the industry could be established that would embrace a high level of automation on a small scale. This scale enables people to implement sustainability practices that provide long term goals, emphasise natural fertilisation and enable smaller productive farms with specific goals.

Chances for cooperation:

Slovenia is running a food production deficit, producing only around 80% of the food it requires. This and the fact that it has an access to its port makes it a good candidate for food imports. The food must however keep in line with the EU standards. A cooperation on this level would mostly be feasible in the non perishable goods. Investments in the canning industry in Cameroon that would transport its produce to Slovenia would gain a lot of traction. Slovenia is also a good candidate for import of frozen fish – as these are relatively expensive due to history of overfishing and lack of facilities that would grow fish on an industrial scale.

On the export side, Slovenia is a good candidate to export knowledge and farming equipment. A large pool of used farming equipment can be bought and refurbished to function in Cameroon giving a major boost to the farming communities. Slovenia also has several specialised farming equipment producers that produce durable but simple farming equipment that could be modified to meet the needs of the farming communities. This could take the form of direct equipment exports or more likely investment in building industries in the region that could produce farming equipment for the extended region.

The practical knowhow of the farmers combined with the advanced knowledge of the faculty could also be harnessed for good effect to develop new farming communities focused on sustainability and producing better and more diversified farming practices.

However you look at it. Farming is in dire need of advancement in both countries. And while the crops grown in them are completely different from one another, lessons learned in one can be translated to the other. Slovenia is facing problems that have been faced by the Cameroonian population for decades and should look to them for answers and adaptation. On the other hand it is expected that Cameroon will undertake similar urbanisation trends as Slovenia did in the 1960-1990 and studying what happened is an important lesson for the burgeoning Cameroon state.

Slovenian Agriculture Read More »